Are you ready to ride the next fintech wave driven by PSD2 with SCA and 3D Secure 2.0?

PSD2 has been created in Europe with firm attention to make the European payment ecosystem more integrated and well structured. The new regulation came into effect on 31st Dec 2020 and is likely to be implemented in the UK from 14th September 2021.

According to the stats released in 2019 and 2020 by ComputerWeekly, the major payment fraud that happened across Europe is expected to be double by 2023. That hit 1.55 in euros with 45% of the fraud alone taking place within the UK. Majority of the frauds involved “Cards not present” purchases, which continued to be followed in 2020 with a booming spark in online shopping. These combat to such high-end frauds and privacy threats, PSD2 has emphasized firmly on SCA (Strong customer authentication).

Therefore, all online transactions must be strongly authenticated and making sure that 2 out of 3 essential factors of SCA are being taken care of:

- Something which the customer knows such as password, PIN.

- Something which customer has such as mobile phone.

- Something customer is such as facial recognition, fingerprint.

SCA will be needed for all online payments taking place within Europe by customers i.e., card payments and all bank-related payments. These recurring payments won’t require Strong customer authentication which will be directly initiated by the merchants.

Before the implementation of PSD2, online payment taking the effect as to rely on 3DSecure 2, which included the information being involved about bank asking for additional customer information and redirecting them to the bank’s page.

This led customers to a hassle-free payment initiation and protecting the confidentiality of their financial data. The improved design dramatically increases the user experience leading to the frictionless flow of payments and successful mobile integration. That means, to ensure a seamless and fast checkout process for merchants.

Now let’s throw some light at how PSD2 will change the dynamics of the European payment ecosystem and encourage major institutions to foster innovation in a competitive business environment.

The three key institutions that will be impacted by PSD2 are:

- All banks within Europe.

- Customers associated with those banks.

- Third-party payment service providers responsible for the initiation of online transactions.

PSD2 has come up with huge opportunities as well as challenges for banks following the traditional approach and lag behind the digital transformation. Banks that allow third-party service providers to access customer’s financial data need to upgrade their infrastructure to ensure smooth offerings for their customers. By implying the full-scale adoption of external entities such as a central bank, TPP’s, etc., banks are expected to get the liberty to execute the personalized products and services resulting in the increased market share.

How can banks gear up for PSD2?

- Collaborating with other banks to get access to the financial data of customers by becoming the third-party payment service providers themselves. This would create room for banks to execute cross-selling, target advertising, and attracting customers based on their data insights.

- With the new regulation, comes the increased modernization of IT architecture and to overcome this combat, increased use of APIs can probably prove to be the best solution APIs will encourage a standardized way to exchange information on different platforms.

- Introduce robust authentication strategies.

- Banks need to make additional investments to ensure multi-factor authentication and educate the customers to ensure seamless shifts.

Impact of PSD2 on third-party payment service providers (TPP’s)

1) Make extra investments in the customer authentication area

The new payment services directive will encourage PSPs to focus on multi-factor authentication, while enabling greater security measures to help merchants and online platforms with smooth integration. They need to find significant ways to make additional investments to modernize current processes and refurbish the integration procedures to various shopsystems, until meet the business requirements.

2) Collecting insights on Customer spending behavior

Under the regulatory law of PSD2, the provision of Account Information Service (AIS) provides PSPs access to customer’s financial data. It can be used by them in order to provide customized products and services depending on customers spending behavior. It can be used to provide customers with a unified view of their important information to different banks.

3) Ensuring Transparency with regulatory controls

The combat PSD2 standards: PSPs need to ensure transparency in a competitive business requirement ensuring high financial discipline as regulatory authorities. That will be taking charge of monitoring their activities and finances with a much closer view.

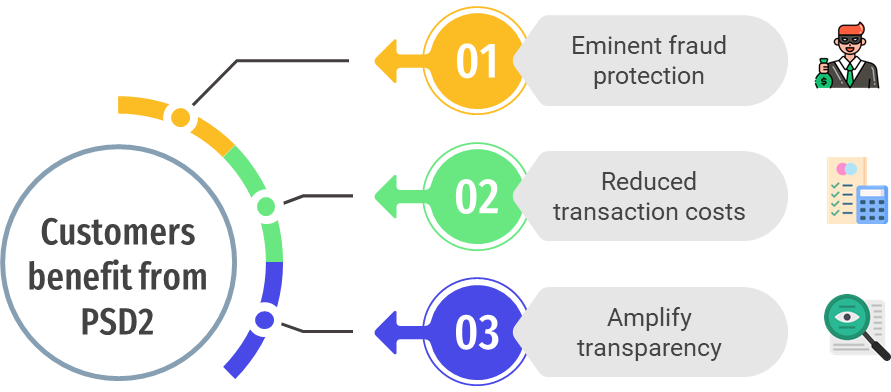

How will customers benefit from PSD2?

1) Eminent fraud protection

The revised payment directive ensures the implication of specified customer protection rules to protect consumers against fraud. Through enhanced security requirements including the use of strong customer authentication across electronic payments.

2) Reduced transaction costs

The implementation of PSD2 will change the payment initiation process of customers by enabling them to pay directly from their bank accounts. It will reduce the participation of multiple parties, thereby reducing the associated hassle.

3) Amplify transparency

The regulatory law of PSD2 mandates the specific terms and conditions associated. The transactions need to be disclosed by PSPs before a transaction is being initiated. This will present a clear picture to customers on processing time, the fee charged, etc. to help them in making a better decision.

Ideatarmac’s Universal Payment Adapter with PSD2 compliance

The implementation of a new directive payment services, we have built a framework in form of our customized payment solution i.e., Universal Payment Adapter includes several integrated plugins and keeping the new regulations as per PSD2 in mind.

It will not just be extremely helpful for merchants and various payment service providers. But it would also help in fostering innovation and increased security for other competitive players, leading to reduced overheads.